How do I receive Credit Card, iDeal and other payments?

Originally written in English, any translations errors should be checked against the original atricle

Use an external payment provider

We have connected several external payment providers like Stripe, Mollie, Worldline and Pay. These can be installed via the AppStore. To do so, login and go to the AppStore. Find the payment provider and install the app.

Use our integrated payment solution

BETA: Our integrated payment solution is currently in BETA. To use it, make sure you enable BETA features.

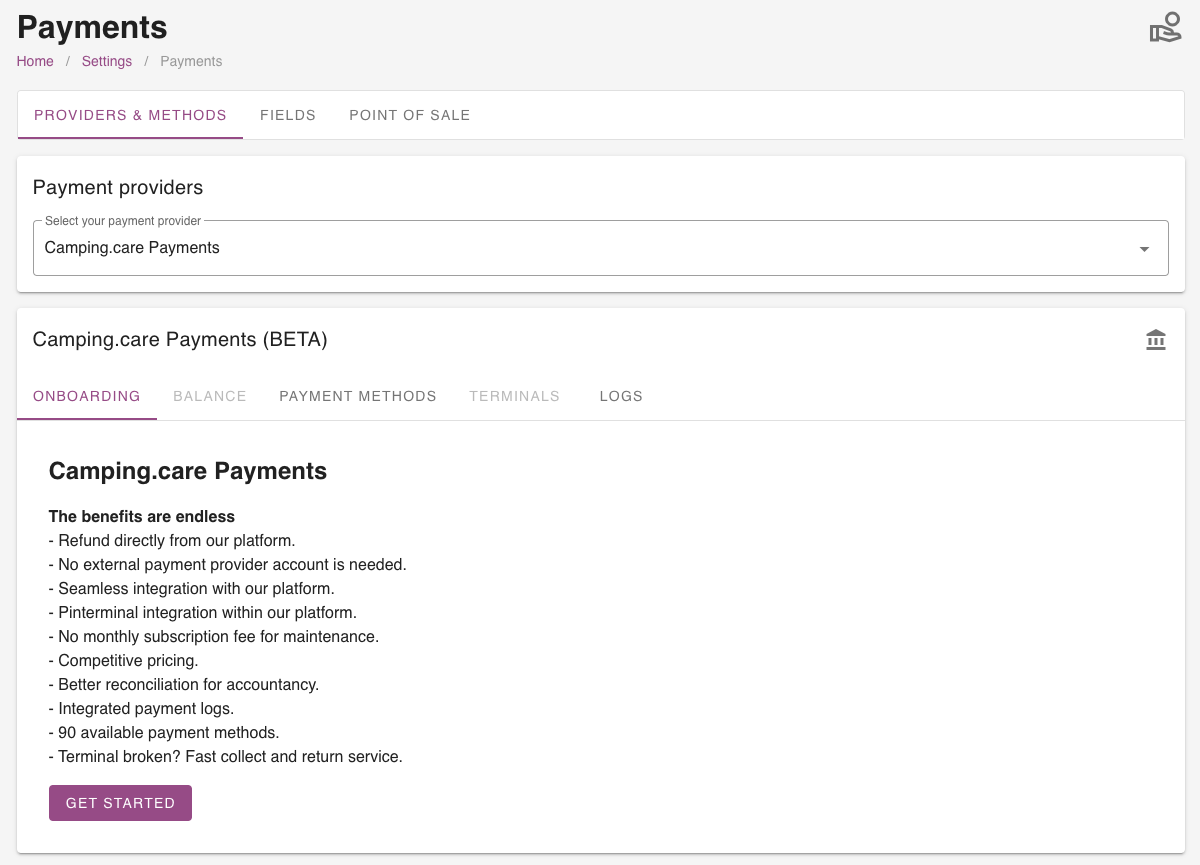

Integrating with our own payment solution is very easy. Login and go to: Settings -> Providers & Methods.

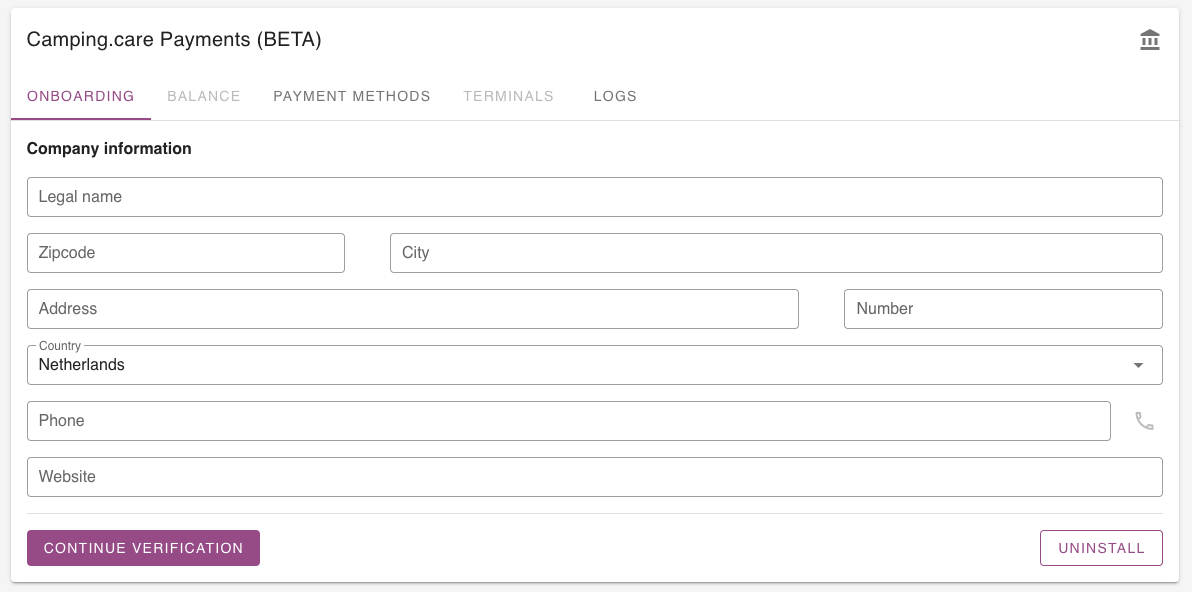

Now you will find the information screen and the ‘Get started‘ button. Click this button to start the onboarding process. In the next step you need to add some additional information to start the onboarding process.

If you have filled in all the fields click on ‘Continue verification’, if all the information is valid you are able to start the onboarding process. You wil be redirected to the onboarding page of the payment provider. They will perform a KYC (Know Your Customer) check to make sure your legal identity is solid and they check your bankaccount.

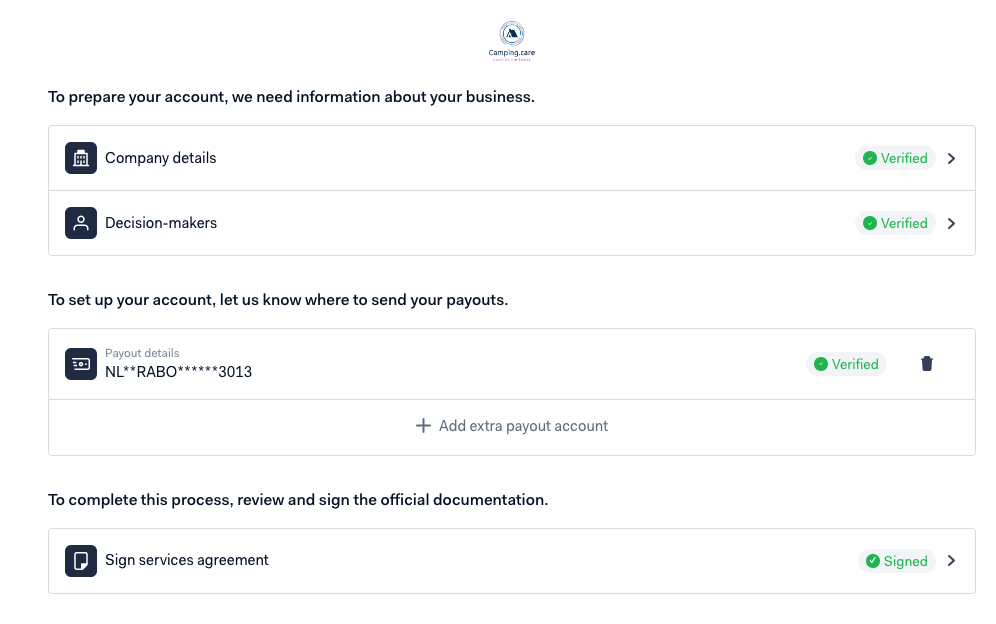

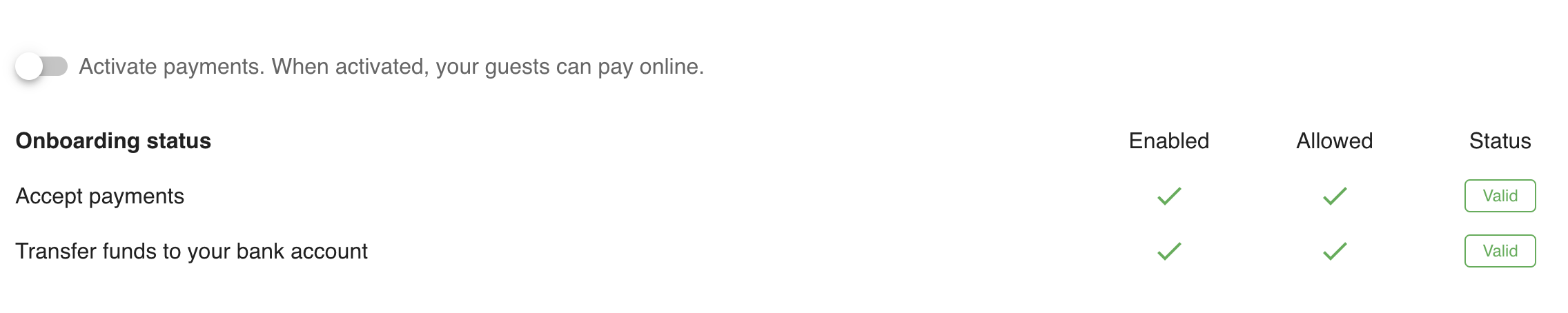

If everything is green / verified you are able to receive online payments (Creditcard, iDeal, Klarna etc.) and we are able to pay you out.

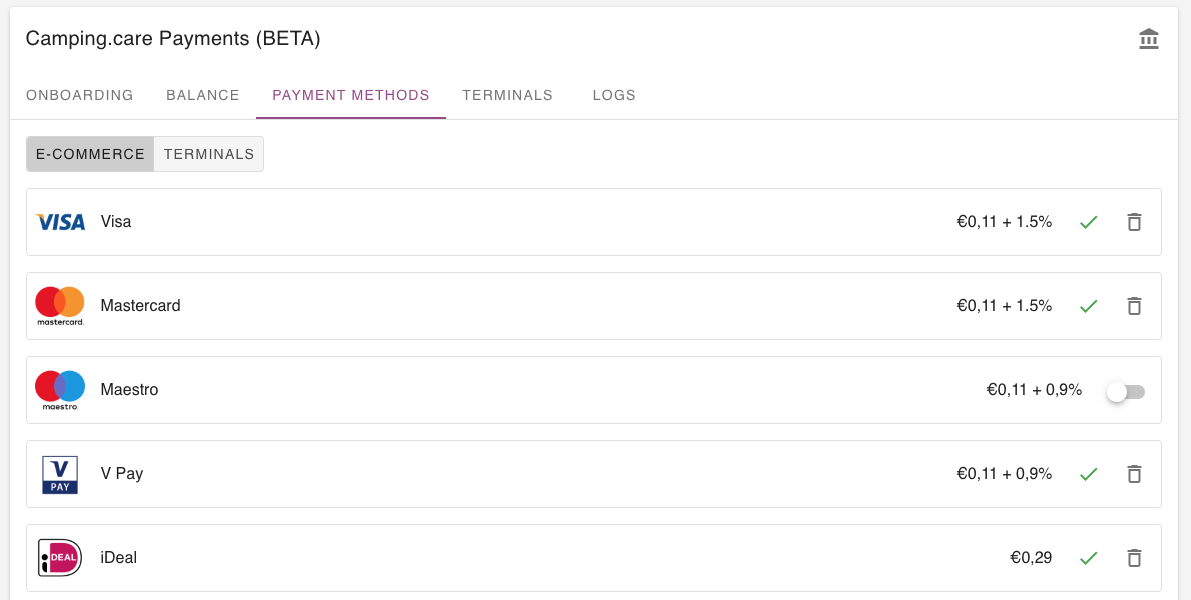

Payment Methods

Go to: Settings -> Providers & Methods -> Methods to select they payment methods you want to use. You can easily enable them with the switch on the right.

It can take a while (~20 mins) before your request have been approved.

Pin terminals

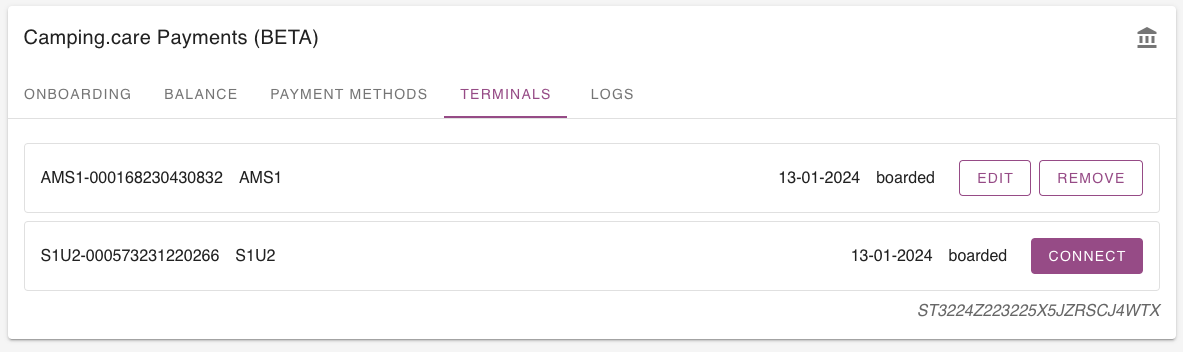

On the terminals tab you will find the pin terminals connected to your account. Click ‘Connect‘ to make them visible in your account and start receiving pin transactions.

Order terminals

We have different pin terminals of different purposes. Like an wireless terminal that is portable or a wired terminal for the reception or kiosk. Please contact us to order your pin terminal.

What is KYC (Know Your Customer)?

In an increasingly global economy, financial institutions are more vulnerable to illegal criminal activities. Know Your Customer (KYC) standards are designed to protect financial institutions from fraud, corruption, money laundering and terrorist financing.

KYC involves several steps to:

- establish customer identity;

- understand the nature of customers’ activities and qualify that the source of funds is legitimate;

- and assess customers’ money laundering risks.

Activate payments

Is the status of accept payments ‘valid’? Then you are able to activate the payments for online booking. This can be done at the top of the page. Once activated, customers are able to process payments.